At Amity Cash Flow, we provide multifamily investment opportunities for both accredited and non-accredited investors to protect and grow their wealth.

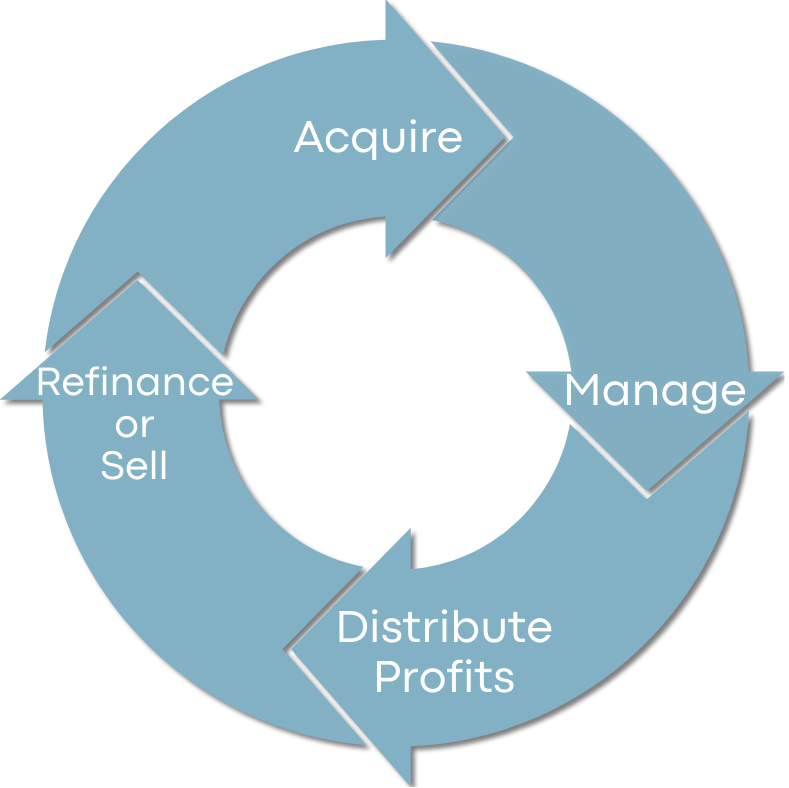

Through our research and strategically formed partnerships, we acquire commercial multi-family apartment properties. We immediately go to work adding value to the properties through refined property management and renovation projects. This produces a better community for our residents, and ultimately creates passive income for our investors through cash flow and profits from sale.

Advisor

Advisor

Advisor

Advisor

Advisor

Advisor

Advisor

Advisor

We source great properties through our broker relationships in each market. After a thorough due diligence period, we secure a loan, raise the capital and close on the property

We hire and align with professional management and then oversee them as they implement our business plan on site.

Rents come in, expenses go out, and the remaining profits get distributed to investors per their ownership share.

Depending on the market conditions and potential returns to investors, we either refinance and hold, or sell the property. Then we rinse and repeat with the next property.

Disclaimer

¹ The testimonials, statements, and opinions presented are applicable to the individuals listed. Results will vary and may not be representative of the experience of others. The testimonials are voluntarily provided and are not paid, nor were they provided with free products, services, or any benefits in exchange for said statements. The testimonials are representative of client experience, but the exact results and experience will be unique and individual to each client.

* All offers and sales of any securities will be made only to Accredited and/or Sophisticated Investors, which for natural persons, are investors who meet certain minimum annual income or net worth thresholds or hold certain SEC approved certifications, or maintain a level of sophistication. Any securities that are offered, are offered in reliance on certain exemptions from the registration requirements of the Securities Act of 1933 (primarily Rule 506C of Regulation D and/or Section 4(a)(2) of the Act) and are not required to comply with specific disclosure requirements that apply to registrations under the Act.

The SEC has not passed upon the merits of, or given its approval to any securities offered by Amity Cash Flow, the terms of the offering, or the accuracy of completeness of any offering materials. Any securities that are offered by Amity Cash Flow are subject to legal restrictions on transfer and resale and investors should not assume they will be able to resell any securities offered by Amity Cash Flow.

Investing in securities involves risk, and investors should be able to bear the loss of their investment. Any securities offered by Amity Cash Flow are not subject to the protections of the Investment Company Act.

Any performance data shared by Amity Cash Flow represents past performance and past performance does not guarantee future results. Neither Amity Cash Flow nor any of its funds are required by law to follow any standard methodology when calculating and representing performance data and the performance of any such funds may not be directly comparable to the performance of other private or registered funds.